By Bahar Gidwani

Over the past few years, thousands of companies both in the U.S. and abroad have raised funds through crowdfunding. Wikipedia defines the term as:

“Crowdfunding is the collection of finance from backers—the "crowd"—to fund an initiative and usually occurs on Internet platforms. The initiative could be a nonprofit (e.g. to raise funds for a school or social service organization), political (to support a candidate or political party), charitable (e.g. emergency funds for an ill person or to fund a critical operation), commercial (e.g. to create and sell a new product) or financing campaign for a startup company.”

We could expect crowdfunding to be especially attractive for younger entrepreneurs. These “millennials” should tend to embrace newer, on-line methods of raising money—especially since they may not have started a venture before using traditional funding means. Companies managed by millennials might also have more socially-positive styles of management than traditional companies and may target markets that care about sustainability and social issues. As a result, we were hopeful that we could combine the 59 million data points in our CSRHub sustainability metrics database with data from Crowdnetic, and reveal a connection between crowdfunding and positive corporate social responsibility (CSR) performance.

Last fall, Crowdnetic, a New York-based company, launched CrowdWatch, a centralized hub that tracks offerings conducted under SEC Rule 506(c). This rule allows private issuers to offer securities through general solicitation, as long as all purchasers are accredited investors and other conditions are met. For more details, see http://www.sec.gov/info/smallbus/secg/general-solicitation-small-entity-compliance-guide.htm. Since CrowdWatch’s launch, Crowdnetic has gathered data on thousands of companies (most of them commercial enterprises) that are seeking to raise funds under 506(c). Crowdnetic aggregates and normalizes companies in its database, in accordance with its proprietary taxonomy. A quick analysis of data gathered through the first half of this year found that 72 of a set of 3,540 companies were in industries such as “green building materials,” “solar & wind power,” or “organic food & beverages.” Given our preliminary analysis, this indicates that crowdfunded companies do not appear to have an especially strong concentration in sustainability-oriented products. The companies that did offer sustainable products were fairly evenly spread over a range of different industries.

We next looked in the CSRHub database for other types of sustainability performance data on the Crowdnetic-tracked companies. Besides product information, CSRHub tracks characteristics such as leadership ethics, employee diversity, transparency and reporting, as well as supply chain practices. We encountered a number of issues with this matching process:

- Companies use many name variants, and a number of companies may share a similar name. The CSRHub database captures thousands of these name variants from its more than 300 sources. Our staff conducted a company-by-company review of each potential match to ensure that we had accurate matches.

- All of the Crowdnetic data set companies were based in the U.S. Only 3,871 or 43% of the roughly 9,000 companies CSRHub rates are in the U.S. This limited our opportunities for matching.

- The companies Crowdnetic tracks are small, privately-held companies (typically under $100 million in revenue). Most of the companies CSRHub rates are large (greater than $100 million in revenue) and publicly traded (we rate about 1,000 private companies, NGOs and government entities).

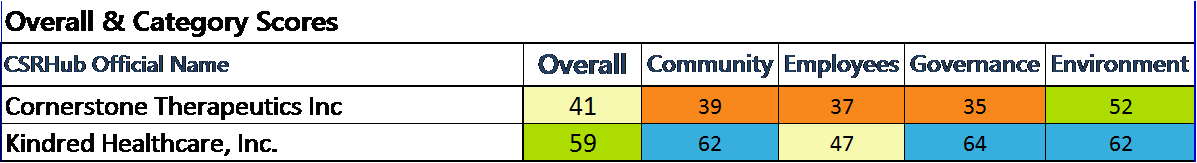

At the end of the matching process, we found only two companies who had both received crowdfunding and had received enough attention for their sustainability performance to be rated by CSRHub.

CSRHub measures how a company is perceived to perform on a wide range of corporate social responsibility (CSR) issues. The average rating for the roughly 9,000 rated companies (across more than 100 countries) stands at around 54. So, one of the rated companies has an overall score below this average, and one has a score above. (Ratings range from a low of around 20 to a high of around 70, but have a strong “central tendency.”) (There are more details about the CSRHub ratings system on our web site.)

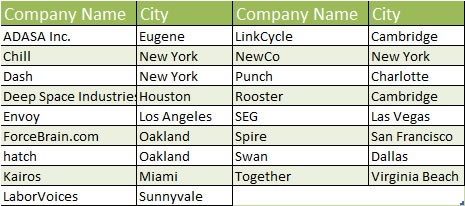

CSRHub has gathered data on more than 100,000 companies that it does not yet rate. CSRHub follows a well-defined set of rules that determine when we can rate any part of a company’s performance and also when we can offer an overall rating. Most of these unrated companies are smaller private enterprises—similar to those that Crowdnetic tracks. We found 17 instances where CSRHub had partial data on a crowdfunded company.

Most of CSRHub’s smaller company information is coming from data gathered via several types of expert sources (supply chain tracking, government regulators and non-governmental organizations) and crowd sources (consumer ratings, employee ratings and sentiment tracking systems). We have data on crowdfunded companies from a number of sources in each of these categories.

Both the number and size of crowdfunded companies are growing. At the same time, the number of companies with publicly-available social performance data and information is also growing. CSRHub’s efforts to collect information on smaller companies should soon allow us to rate 90,000 or even 900,000 companies instead of 9,000. Over the next few years, the overlap between our data sets should grow rapidly.

Crowdnetic’s statistics indicate that a small percentage of crowdfunded companies currently offer products or services in areas that are viewed as sustainable, such as organic food, energy-saving devices, social services or community impact programs. CSRHub statistics do not include enough crowdfunded companies yet to tell if they have measurably better internal social behavior than non-crowdfunded companies. We continue to believe that a connection is likely and will reexamine this question as soon as we have a broader overlap between the CrowdWatch and CSRHub data sets.

Bahar Gidwani is CEO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. Bahar is a member of the SASB Advisory Board. He plays bridge, races sailboats, and is based in New York City.

Bahar Gidwani is CEO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. Bahar is a member of the SASB Advisory Board. He plays bridge, races sailboats, and is based in New York City.

About CSRHub:

CSRHub provides access to corporate social responsibility and sustainability ratings and information on 9,100+ companies from 135 industries in 104 countries. Managers, researchers and activists use CSRHub to benchmark company performance, learn how stakeholders evaluate company CSR practices and seek ways to change the world.

CSRHub rates 12 indicators of employee, environment, community and governance performance and flags many special issues. We offer subscribers immediate access to millions of detailed data points from our 339 data sources. Our data comes from nine ESG (environment, social, governance) analysts, well-known indexes, publications, “best of” or “worst of” lists, NGOs, crowd sources and government agencies. By aggregating and normalizing the information from these sources with its patent-pending system, CSRHub has created a broad, consistent rating system and a searchable database that links each rating point back to its source.

CSRHub is a B Corporation, an Organizational Stakeholder (OS) with the Global Reporting Initiative (GRI), a silver partner with Carbon Disclosure Project (CDP), a founding member of The Alliance of Trustworthy Business Experts (ATBE), an advisory board member of Sustainability Accounting Standards Board (SASB) and supports both the Global Initiative for Sustainability Ratings (GISR) and the International Integrated Reporting Committee (IIRC).

About Crowdnetic:

Crowdnetic is a leading provider of technology and market data solutions to the global crowdfinance marketplace. They operate the industry’s premier centralized hub for real-time market data aggregated from platforms across the globe.

Founded in 2011 by experienced financial technology and data industry experts, Crowdnetic is committed to creating a productive and sustainable marketplace for the global crowdfinance industry. Bringing over 15 years of experience in building complex, data-intensive customized solutions, the leadership team has been instrumental in revolutionizing the industry through developing market data and analytics solutions.

Crowdnetic owns and operates CrowdneticWire.com, Lendvious.com, CrowdWatch.co and is a co-producer of the premier peer-lending conference, LendIt, the largest and most recognized conference in the P2P and online lending industry.

.png)