By Bahar Gidwani

It seems that “sustainability” was a core topic at this year’s World Economic Forum (WEF) conference at Davos. Many talks centered around the idea of a “fourth industrial revolution” and all of the changes in corporate behavior that would result.

The conference created good opportunities to release new lists of sustainable companies and new index products designed to help investors use their money to encourage positive changes in corporate behavior. For instance, our friends at Corporate Knights released the latest edition of their well-respected Global 100 list.

A quick test of the top ten companies on the Global 100 list shows that they have strong average CSRHub ratings. Nine of the ten companies are 80% percentile or better and CSRHub’s analysis indicates that all are above average performers compared to both the other companies in their country and their industries.

However, another set of companies was singled out at the meeting and the members of this list did not show similarly strong sustainability characteristics. The new list was the S&P Long-Term Value Creation (LTVC) Global Index. S&P selected the companies for the LTVC using data from RobecoSAM (the creator of the Dow Jones Sustainability Indexes) with input from the Canada Pension Plan Investment Board (CPPIB). Since CPPIB is a co-founder of a group called “Focusing Capital on the Long Term,” the Wall Street Journal article on this announcement suggested that this new index would also be supported by other Focusing Capital co-founders such as McKinsey & Co. and BlackRock Inc. In fact, BlackRock has already committed to invest $2 billion under the direction of this new Index.

The S&P’s web site entry on the LTVC says it is supposed to contain stocks “ranking highly in global equity markets, using both proprietary sustainability and financial quality criteria.” The methodology document describes how RobecoSAM’s Economic Dimension scores are combined with S&P’s Dow Jones Indices Quality scores to generate the rankings. Economic Dimension scores are driven by code of conduct issues, compliance and corruption problems, measures of innovation and indicators about how supply chains are managed. A company’s Quality score is the result of combining calculations of return on equity, accrual of assets, and financial leverage.

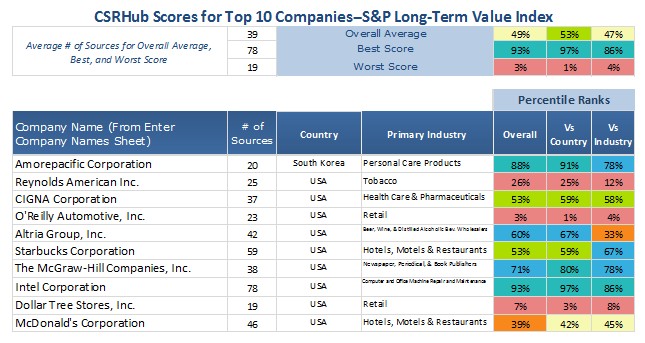

While there are 246 companies in the LTVC, S&P doesn’t disclose the full list. In fact, it only shares the top ten components. A quick look at these ten companies shows a striking difference to what we saw with the Global 100.

CSRHub’s data indicates that only five of the top ten companies in the S&P list have above average perceived sustainability performance. Two of them—O’Reilly Automotive and Dollar Tree Stores—are in the bottom 10% among the over 15,000 companies that CSRHub tracks.

S&P’s new index may tie well to long-term value creation. It may even capture factors that tie to long-term stock market appreciation. But, it does not seem fair to characterize this group of companies—at least from what we can see here—as “ranking high…on sustainability characteristics.” Perhaps it is time for those of us who track corporate responsibility and care about the metrics we have created, to take back the term “sustainability”? We could then make sure that our favorite word is only used where it truly applies.

Bahar Gidwani is CEO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

Bahar Gidwani is CEO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

CSRHub provides access to the world’s largest corporate social responsibility and sustainability ratings and information. It covers over 15,000 companies from 135 industries in 132 countries. By aggregating and normalizing the information from 435 data sources, CSRHub has created a broad, consistent rating system and a searchable database that links millions of rating elements back to their source. Managers, researchers and activists use CSRHub to benchmark company performance, learn how stakeholders evaluate company CSR practices, and seek ways to improve corporate sustainability performance.

.png)