Do bigger companies get better ESG ratings than small ones? We believe the answer is “no.” This seems true across a wide range of companies, whether one measures size by revenue or by market capitalization (a proxy for enterprise value). Our result indicates that small companies can and should expect to be able to equal or outperform their bigger rivals on environment, social, and governance (ESG) issues.

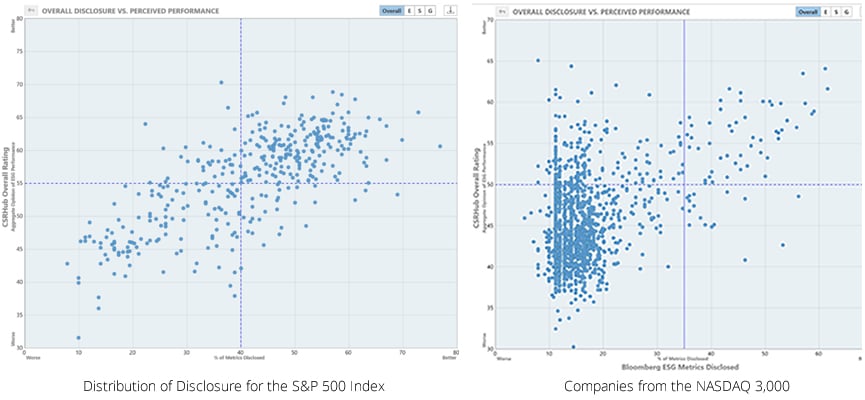

A comparison of charts from our new Bloomberg app (ESGHub) indicates that big companies disclose more information than small ones. The chart on the left shows the distribution of disclosure for the S&P 500 Index. There is a wide dispersion of disclosure profiles (as measured by Bloomberg’s ESG Metrics on the bottom axis) and CSRHub’s consensus ESG rating (as shown on the vertical axis). The chart on the right shows about 1,500 companies from the NASDAQ 3,000. There are some companies spread out on the right. However, many companies are clustered to the left with low disclosure scores.

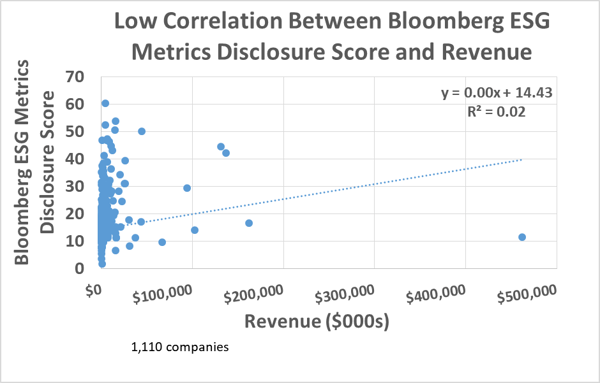

Even though the smaller companies are hard to distinguish based on their disclosure, they do separate on the vertical axis (aggregate ESG rating). The left-right distinction does not appear to be related to size. As you can see below, larger companies have only a small tendency towards higher disclosure ratings from Bloomberg.

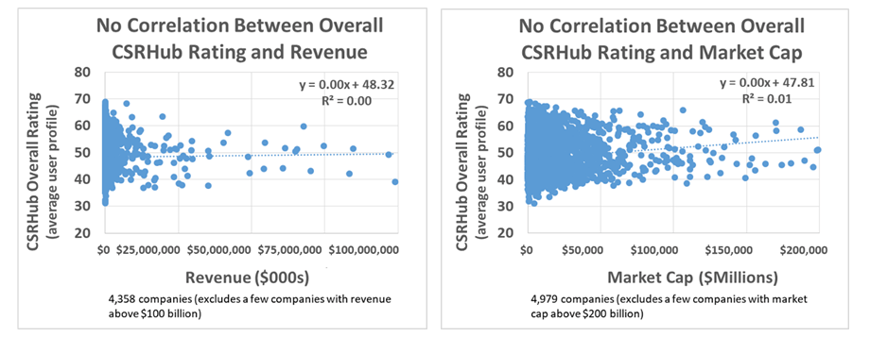

The aggregate ESG ratings from CSRHub also do not appear to be driven by either revenue (left chart below) or market capitalization (right chart below). This pattern has been stable for at least the past five years. One theory is that the sustainability story of smaller companies may be simpler and easier to tell than those for large ones. Smaller companies may also appear more credible on ESG issues, due to cultural biases against “big business.”

Bahar Gidwani is CTO and Co-founder of CSRHub. Bahar has built and run large technology-based businesses for many years. Bahar holds a CFA (Chartered Financial Analyst) and was one of the first people to receive the FSA (Fundamentals of Sustainability Accounting) designation from SASB. Bahar worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. He has founded several technology-based companies and is a co-founder of CSRHub, the world’s broadest source of corporate social responsibility information. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

Bahar Gidwani is CTO and Co-founder of CSRHub. Bahar has built and run large technology-based businesses for many years. Bahar holds a CFA (Chartered Financial Analyst) and was one of the first people to receive the FSA (Fundamentals of Sustainability Accounting) designation from SASB. Bahar worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. He has founded several technology-based companies and is a co-founder of CSRHub, the world’s broadest source of corporate social responsibility information. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

CSRHub is the largest ESG and sustainability rating and information platform globally. We aggregate data points from data sources including leading ESG analyst databases. Our patented algorithm aggregates, normalizes, and weights data to rate 18,000 companies in countries across industries. We track 97% of world market capitalization. We cover 12 subcategories of ratings and rankings across the categories of environment, employees, community and governance. We show underlying data sources that contribute to each subcategory’s ratings. CSRHub metrics are a consensus view (any 2 sources may have about a 30% correlation so we make sense of the disparate data). We tag companies for their involvement in 17 Special Issues. We provide Macro-enabled Excel dashboard templates, customizable dashboards, and an API. Our big data technology enables 85% full coverage of data across our rated companies and robust analyses. We provide historical ratings back to 2008.

.png)