The researchers at StockSnips have been transforming unstructured data into financial sentiment insights for several years. Their AI / ML (Artificial Intelligence / Machine Learning) based system reads thousands of articles and tags the relevant snippets to derive a quantified investor sentiment measure that could drive stock performance. StockSnips has now developed an ESG (Environment, Social, and Governance) signal leveraging the platform used for its Financial Media Sentiment. We have begun adding this data set into CSRHub’s consensus measure of entity ESG performance.

StockSnips provides daily readings on the ESG sentiment for about 1,000 companies. It calculates what it calls “ESG Sentiment Signal” plus moving average signals across various timeframes. We compared 50 day, 365 day, and deviation numbers against CSRHub’s scores. Because CSRHub’s ratings lag about two months behind the current day, we had to use historic StockSnips data.

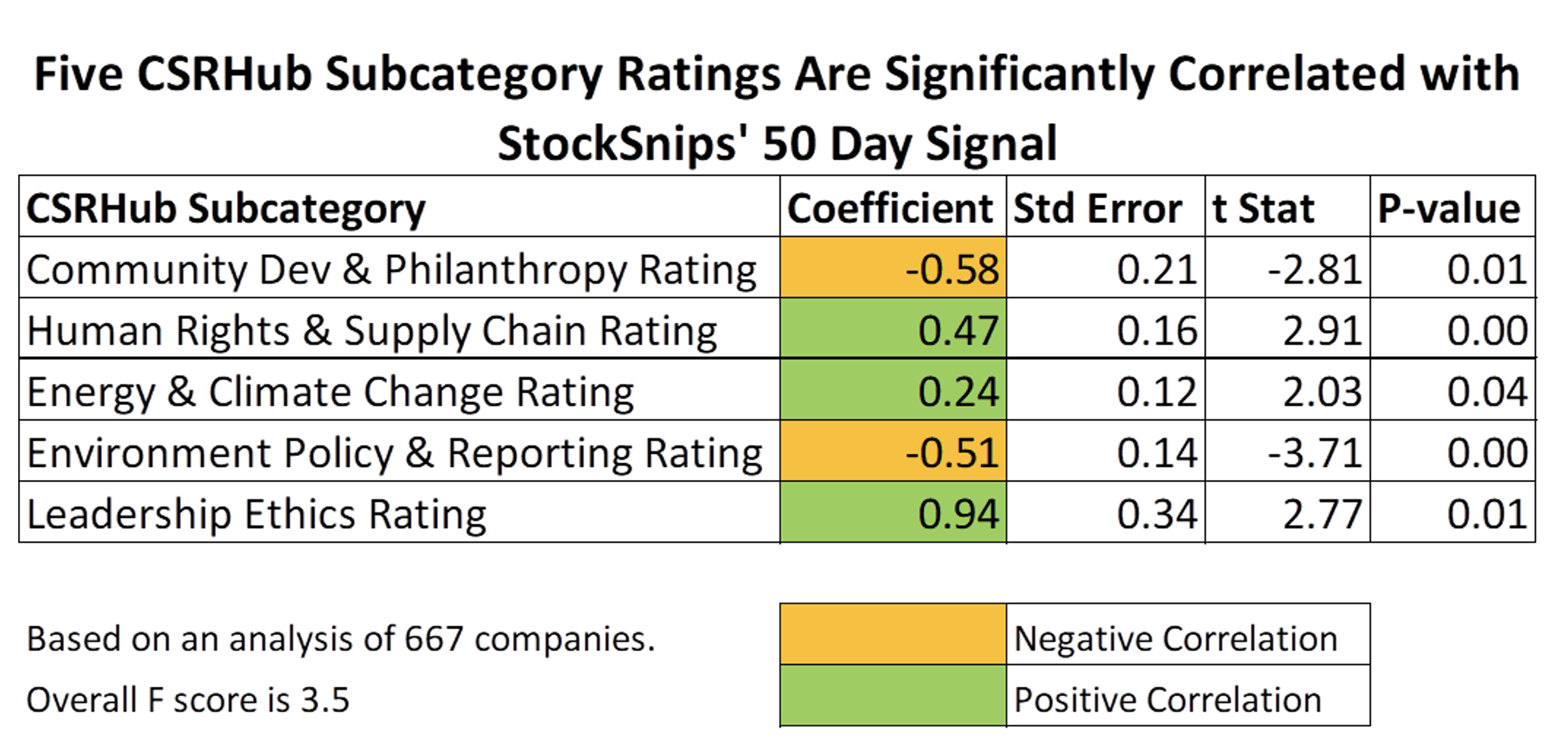

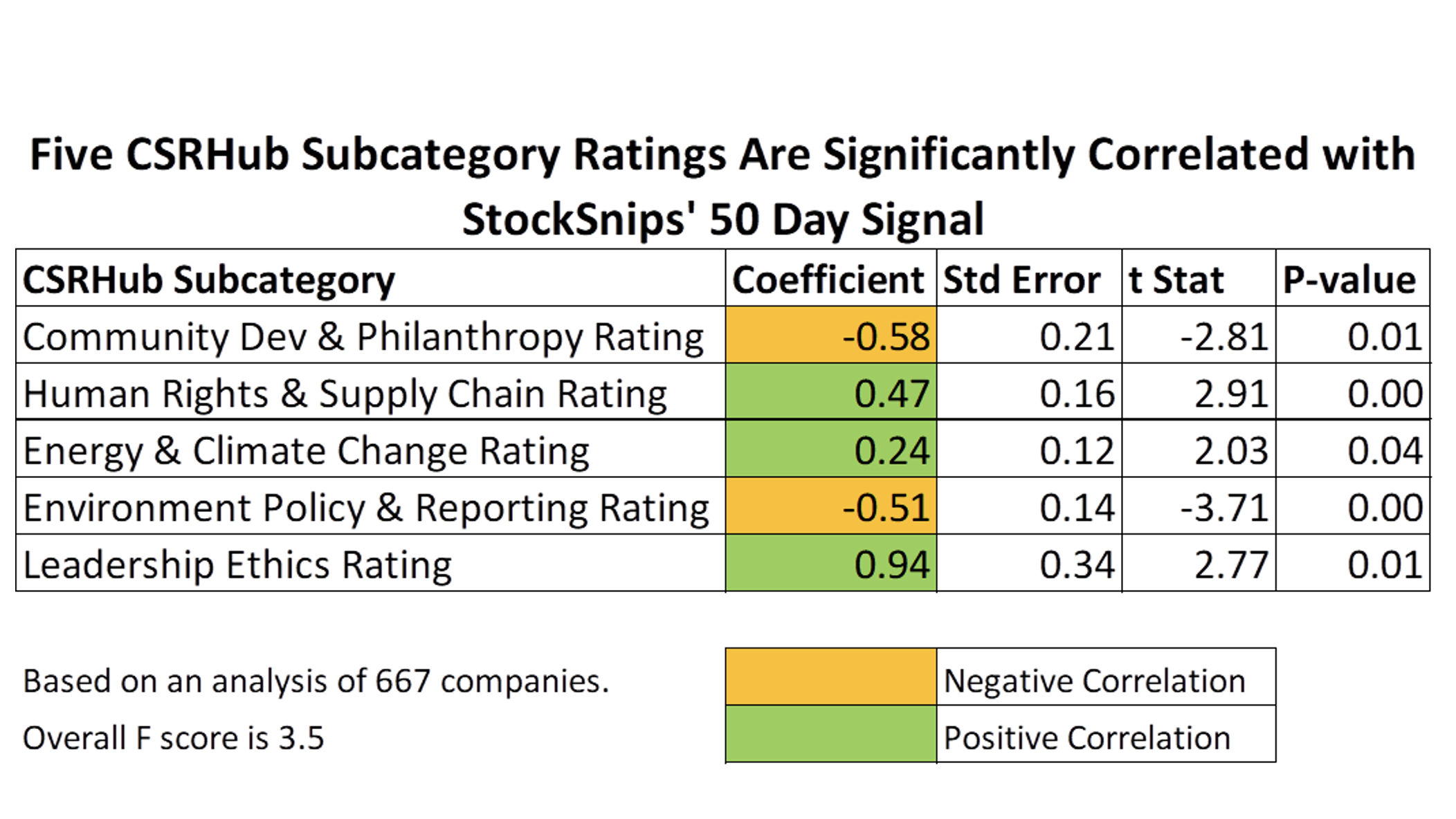

Our regression showed little correlation between the StockSnips scores and CSRHub’s Overall rating. However, the variation in five of CSRHub’s twelve subcategory ratings had statistically significant relationships with variations in StockSnips 50-day sentiment signal. The T Stats for each of these relationships were above 2 (probability of random occurrence < 5%) and F score for the analysis was more than 3 (probability of random occurrence < 0.0001%).

As you can see, three of CSRHub’s subcategory scores were positively correlated while two were negatively correlated. This “split” relationship is similar to one we found years ago, when examining a data set of risk information. We suspect that discussions about certain topics reduce expert trust in a company, even when ESG Sentiment detects that the tone of the discussion is favorable.

For instance, CSRHub’s Community Development & Philanthropy rating for Alamos Gold is 63—a relatively high score. However, the StockSnips 50-day sentiment signal is 40. (The 30 day signal is slightly higher—43.). Alamos is involved in mining and must deal with many controversies and disputes. It has only 9 sources on CSRHub—even though we have fully rated it since 2013. The CSRHub expert source assessment may be missing issues and signals that StockSnips’ technology picks up. Or, the “voices” that StockSnips listens to may not understand that Alamos is doing better on community issues than many other mining companies.

As interest grows in AI-based Sentiment, they will become increasingly influential. They will interact with our other sources and provide a fresh perspective on company ESG performance. We are excited about adding this point of view to our aggregation engine and hope that our clients will appreciate the new view it brings to our system.

Bahar Gidwani is CTO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

Bahar Gidwani is CTO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

About StockSnips Inc:

StockSnips is a Pittsburgh based company founded by computer and data scientists. Our vision is to provide easy access to stock market news sentiment analysis to investors. Understanding market sentiment trends can provide an edge and our aim is to provide high quality alternative data and AI Sentiment-based portfolio models. Our memory-based model for deriving sentiment considers the discrete and infrequent nature of news, and has been validated for Long / Short investment strategies and has outperformed other portfolio factors. Our products are the fruits of research collaboration by AI experts, data scientists with active investors.

.png)