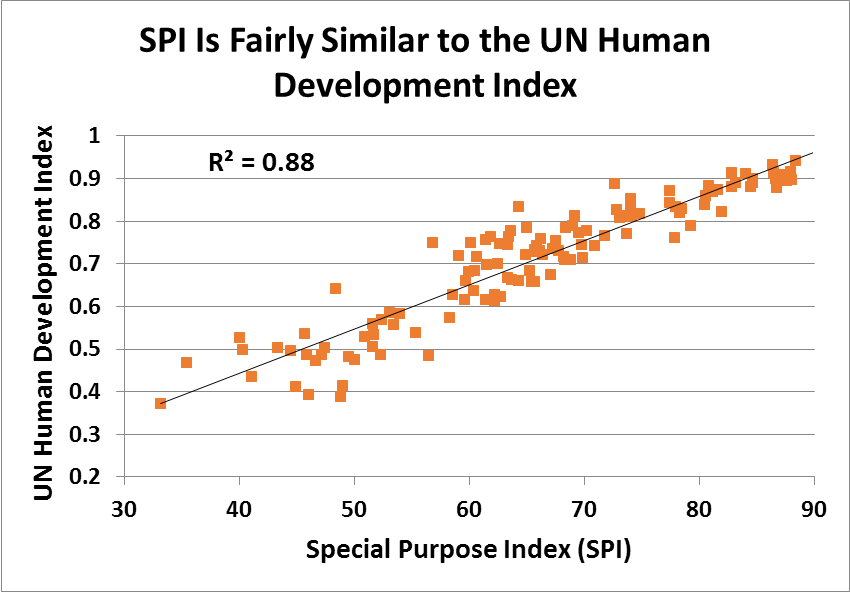

Bahar Gidwani, CSRHub ratings, UN HDI, United Nations Human Development Index, SPI, CSRHub, Social Progress Index, Corporate Sustainability Metrics, ESG Metrics Research

The Relationship Between Corporate Sustainability and Human Development

By Bahar Gidwani