Asset4/ThomsonReuters, Bahar Gidwani, CSR, social issues, IW Financial, MSCI, Vigeo, CDP, corporate citizenship, Just Capital, Russell 1000 index, Just 100, sustainability ratings sources, ESG Metrics Research

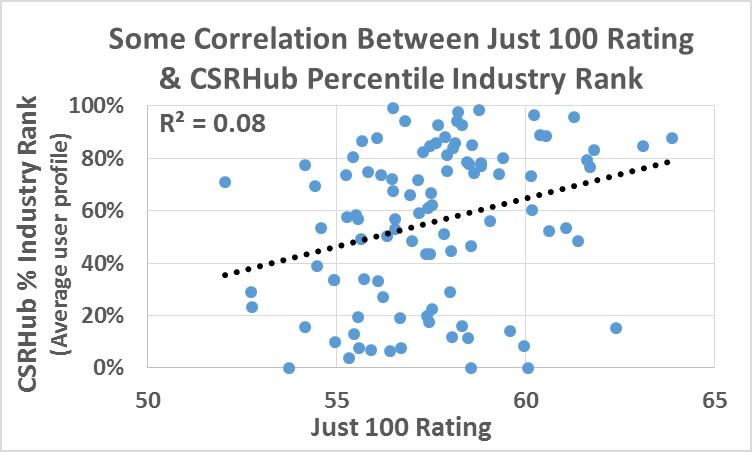

Understanding the Just 100

By Bahar Gidwani