Just Capital was established in 2015 by two successful and well-known investors: Paul Tudor Jones and Martin Whittaker. Its mission is to use “the power of markets to drive positive change on the issues Americans care most about.” After two years of research and reflection, Just Capital has now published a list of the 100 best “corporate citizens.”

We’ve been interested in this project from its inception and provided the Just Capital research team with access to our ratings and other data. Unlike other ratings systems that attempt to decide what things are good behavior or bad behavior, Just Capital sought the opinion of ordinary citizens about what defines good corporate citizenship. When they released the first readings from these surveys last year, it caused a stir within the sustainability community by showing that social and ethics issues were more important to most Americans than environment or other governance issues.

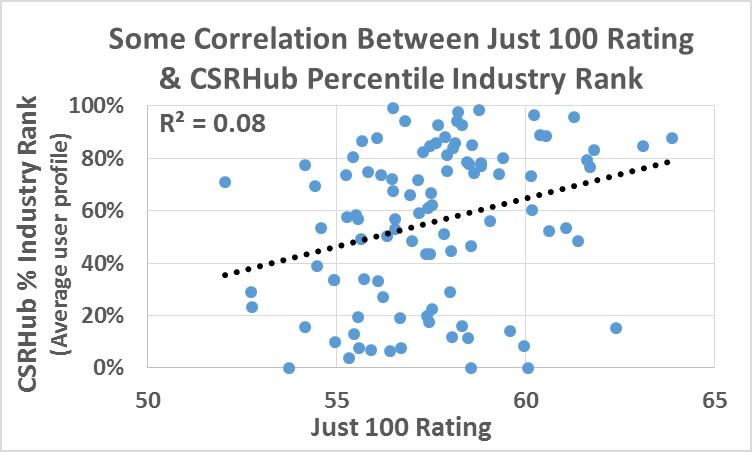

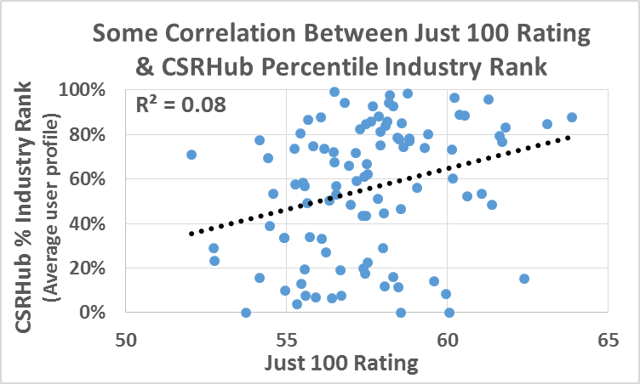

We suspected that Just Capital’s approach would generate ratings that differ from those of the other 491 ratings sources we integrate into CSRHub’s data set. A simple comparison between the top 100 company ratings and CSRHub’s ratings shows there is about an 8% R Squared between Just Capital’s perspective on corporate social responsibility (CSR) and that of CSRHub’s aggregate of all other sustainability rating sources.

For this first review, Just Capital chose to focus on components of the Russell 1000 Index. They pointed out that this group of companies has a large market capitalization and that most are headquartered in the US. (Only around 40 of the current members of the Russell 1000 Index have non-US headquarters.) One of the planned uses for the Just ratings is to encourage US investors and consumers to support “just” companies. Investors may find this first list useful, but US consumers and businesses buy products and work with hundreds of large foreign companies that have not yet been evaluated.

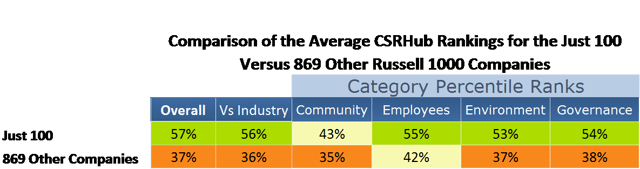

Just Capital looked at about 90% of the companies in the Russell 1000 Index. It sought to discover how these companies performed across 67 different metrics. CSRHub covers 969 companies from this Index and has access to around 3,000 different metrics on these companies. Just Capital had to make a number of assumptions and adjustments to account for missing data. CSRHub’s system automatically adjusts for missing data issues through its normalization and weighting algorithms. Despite these methodological differences, there is some agreement between our systems. In particular, the 100 companies Just Capital picked did have better average performance using CSRHub’s rating system than the other 869 companies we rate in the Index.

On the other hand, there were some major differences between our rating systems. 19 of Just’s top 100 companies had overall CSRHub ratings that were in the bottom quintile (lowest 20%) of the 16,500 companies we track. 69 of the 869 companies that didn’t get into the Just 100 were in the top quintile of CSRHub’s ratings system. To put it another way—the five top-scoring companies in the Just 100 had an average CSRHub rating of 59. More than 100 of the other 869 that didn’t make the list had CSRHub scores above 59.

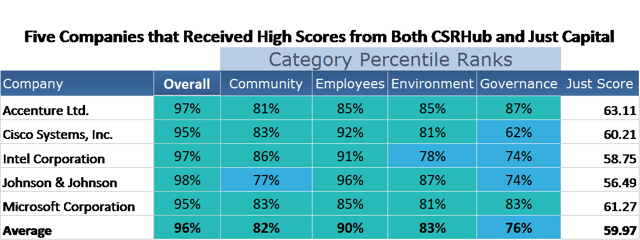

In order to better understand the difference in our results, we looked at individual examples. Companies like Accenture, Intel, Cisco, Johnson & Johnson, and Microsoft were both in the Just 100 and at or near the top of CSRHub’s ratings. (The average overall CSRHub percentile rank for these five companies was 96%, which means they were perceived in our system to perform better than more than 15,000 other companies.) As we would expect, these companies had especially strong average scores in the Employee area (average 90% performance) and somewhat lower average scores on Environment and Governance issues (83% and 76%).

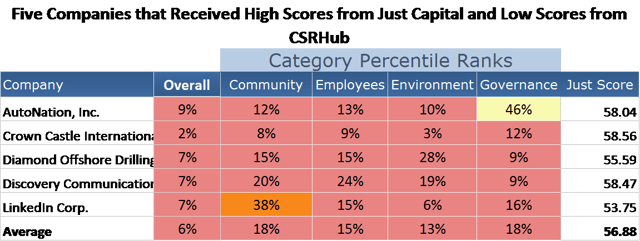

The other end of the spectrum was more puzzling. Here are five examples of where CSRHub’s view diverged with those of Just Capital.

Both Just Capital and CSRHub attempt to remove the influence of issues such as company size. The ratings we have been using from Just Capital are their “relative” ranking—the measure of a company’s performance compared to others in its industry. CSRHub’s rankings are also relative (since most of CSRHub’s sources take an industry-centric view of performance) but span all entities rather than just those in one industry. Many of our sources overlap (and Just Capital had access to CSRHub’s ratings during its research process). So, why are these five companies included in the Just 100?

The Just Capital folks deserve huge credit for transparency. There is a tear sheet report on each of the companies in the Just 100—so it is fairly easy to see what factors swayed them to feel that a company deserved to be included. CSRHub has a similar level of transparency—our users can inspect which sources we used and most of the data details that underlie our scores.

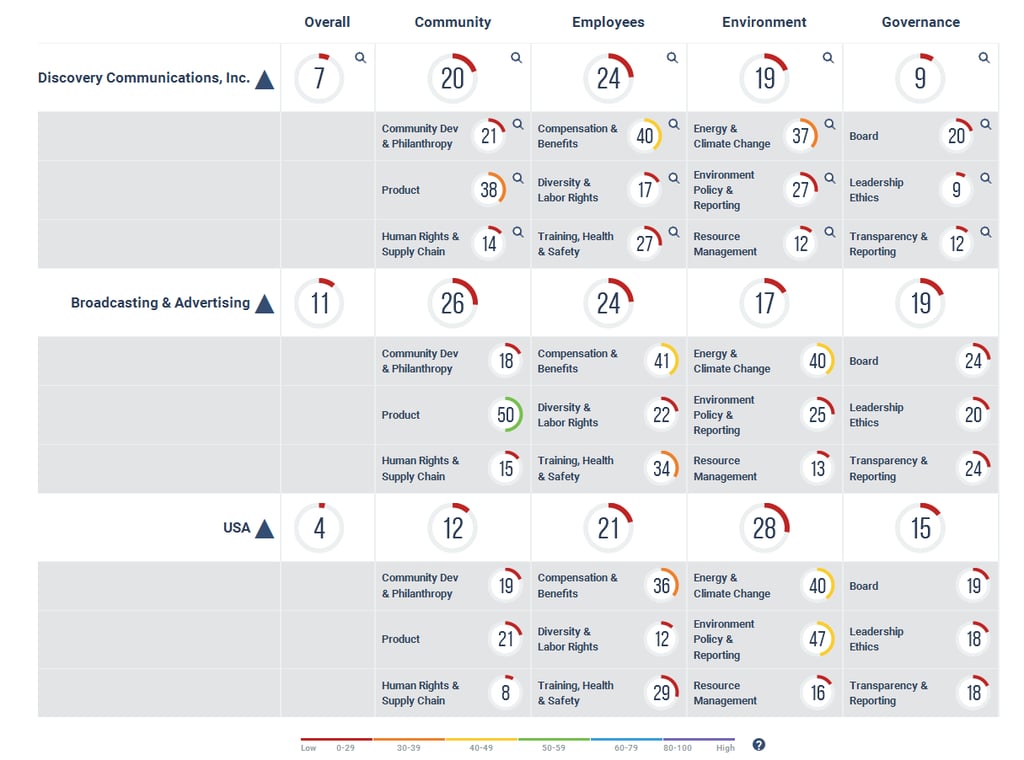

For instance, CSRHub has 62 sources and more than 1,200 ratings indicators for Discovery Communications. Our systems show below average performance for all aspects of sustainability performance when compared to all of the companies we track (top section), the 128 Broadcasting and Advertising industry companies in our system (middle section), and the 6,374 US companies we have ratings for (bottom section).

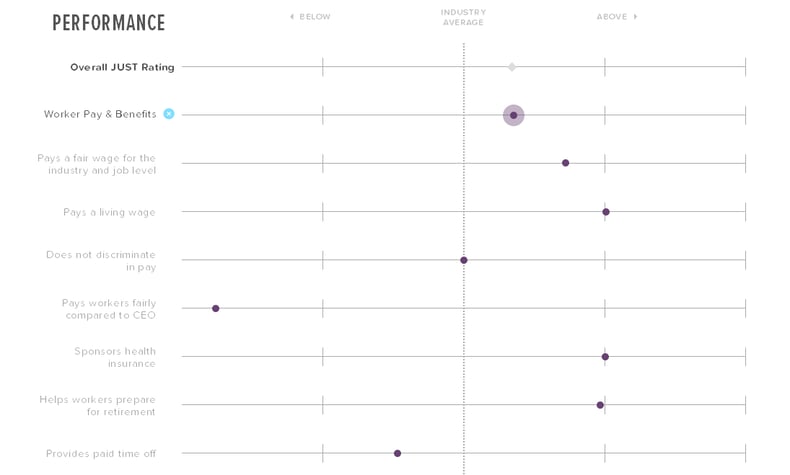

In its drill down, Just Capital gives Discovery an above average score on Worker Pay & Benefits based on 7 subscores.

CSRHub’s rating for this labor/pay topic are informed by 20 sources. There are many negative reports, including:

- No same-sex benefits (IW Financial).

- No tie of compensation to overall climate performance (CDP).

- Poor career management and promotion policies (Vigeo).

- Low pay relative to global standards (MSCI ESG Governance Metrics).

- Lack of Employment Quality monitoring systems (Thomson/Asset4).

These reports are offset somewhat by a positive score from Glassdoor regarding employee satisfaction (this 3.7 score is about 70th percentile) and 2014 awards from Forbes (Best Workplace), Best Workplace for Commuters, and Working Mother Magazine. (Note though that only Working Mother repeated its award for 2015.) It is hard to prove that Discovery deserves a poor score on this topic—but it is easy to see why others might disagree with Just Capital’s assessment.

Just Capital is well supported, media savvy (its launch events have been well attended and its article in Forbes received an “editor’s choice” star), and has a mission that resonates well with the general public. It has taken a fresh approach to the challenge of evaluating corporate social behavior and its staff spent months forming its opinions. Just Capital also reached out to the companies it was evaluating and invited them to contribute information. For instance, Just Capital indicates in its tear sheet that Discovery plans to add same sex benefits for its employees in 2017. When this is confirmed (and incorporated into the research done by CSRHub’s partners), it may “flip” some of the negative indicators we mention above.

CSR managers for companies who appear on the Just 100 should celebrate their good fortune. Companies who did not should ask Just Capital to share the details that drove its assessment of their performance. The CSR managers in these companies may then find facts that could be updated or corrected or areas where new programs could respond to Just Capital’s concerns. As Just Capital expands its coverage and continues publicizes its ratings, we hope we will see benefits from its work for both corporations and consumers. CSRHub plans to start incorporating Just Capital ratings into its analysis with its November data set, so that CSRHub users will be able to integrate this new perspective into their broader CSR communications program.

Bahar Gidwani is CEO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

CSRHub provides access to the world’s largest corporate social responsibility and sustainability ratings and information. It covers over 16,000 companies from 135 industries in 133 countries. By aggregating and normalizing the information from 491 data sources, CSRHub has created a broad, consistent rating system and a searchable database that links millions of rating elements back to their source. Managers, researchers and activists use CSRHub to benchmark company performance, learn how stakeholders evaluate company CSR practices, and seek ways to improve corporate sustainability performance.