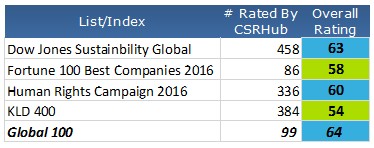

Bahar Gidwani, sustainability performance, Corporate Sustainability Metrics, ESG Metrics Research, Legal Violations, Good Jobs First, Violation Tracker

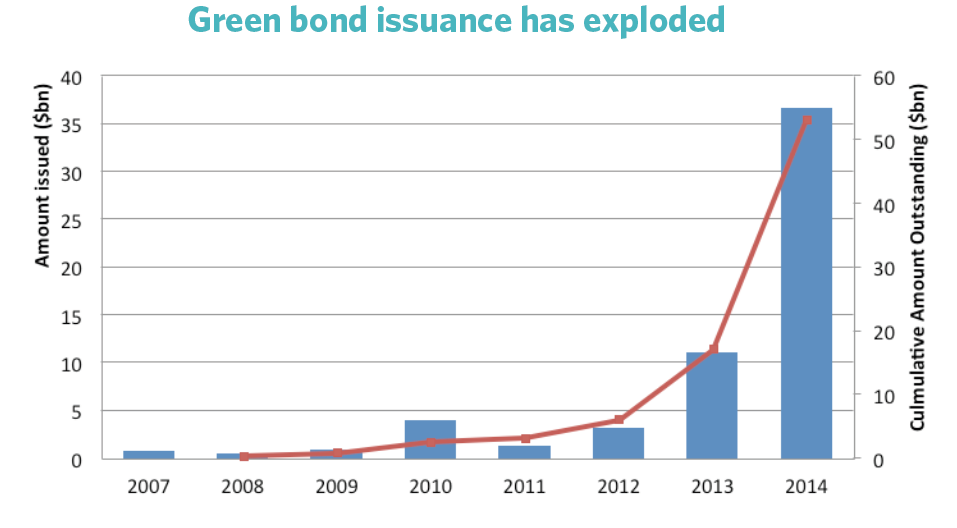

The Effect of Legal Violations on Perceived Sustainability Performance

By Bahar Gidwani