Bahar Gidwani, European Investment Bank, fixed income product, Skandinaviska Enskilda Banken (SEB), World Bank, invest, socially responsible investors, sustainability performance, CSRHub, green bonds, SRI, ESG Investing, ESG Metrics Research

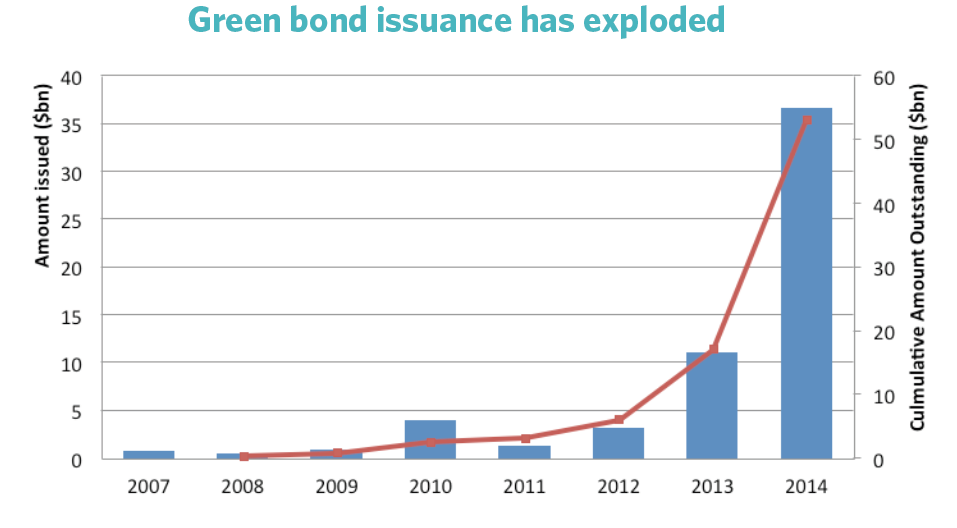

Green Bond Issuers Appear to Have Higher Than Average Perceived Sustainability Performance

By Bahar Gidwani