By Bahar Gidwani

This is part 1 of a 3-part series on Implementing SASB.

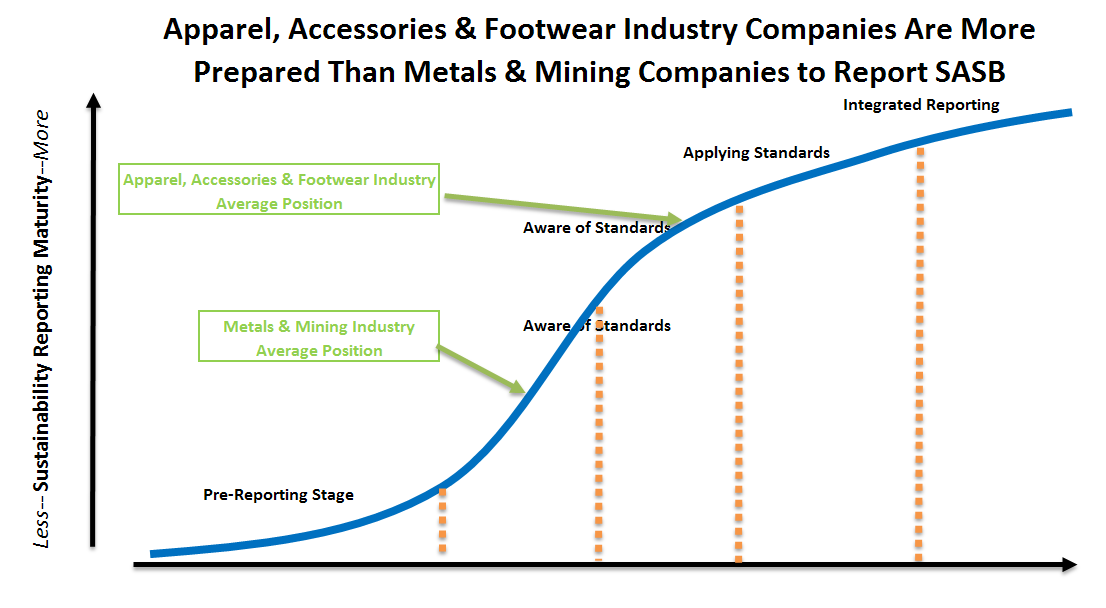

Over the past six months, we have been working with the Sustainability Accounting Standards Board (SASB) on a series of reports we call the Sustainability Accounting Standings Series (SASS). The reports are designed to help companies understand SASB’s guidance on the sustainability-related information that reasonable investors would consider material in their SEC filings. We have used CSRHub’s vast library of reporting information (we have collected 91 million pieces of corporate sustainability data and rate more than 15,500 companies) to assess the readiness of 280 companies in the Apparel, Accessories & Footwear (AA&F) and 1,799 companies in the Metals & Mining (M&M) industries. Although these completely different industries are each at a different stage in their journey towards integrated reporting, they face a number of common issues as they move towards integrating SASB’s guidance into their financial reporting.

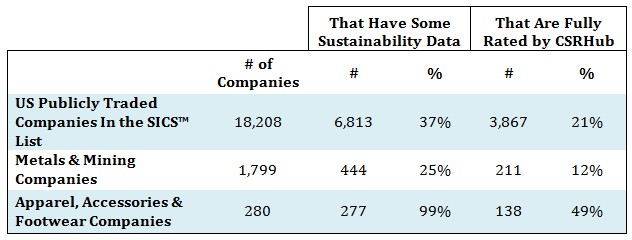

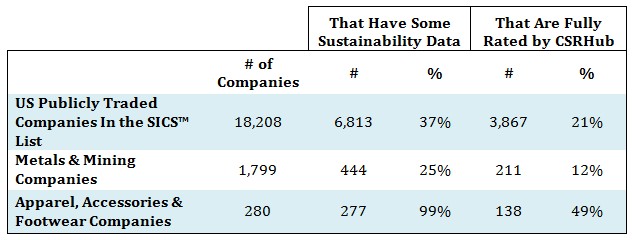

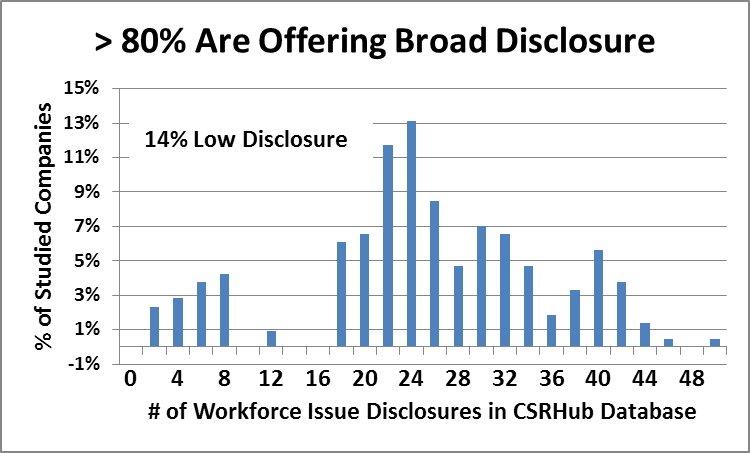

We used the SASB industry Classification System (SICS) to select the companies to study in each report. The table below shows that M&M companies are far behind AA&F on their reporting and disclosure practices.

On the other hand, almost all AA&F companies have disclosed at least some sustainability data and almost half have reached the point where they can receive full CSRHub ratings.

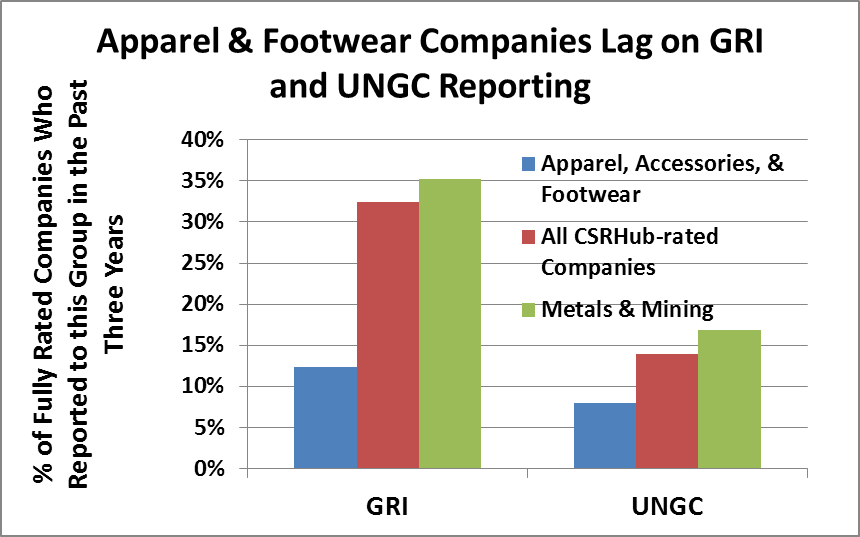

In contrast, the M&M companies CSRHub can rate tend have much higher rates of commitment to external reporting systems such as the Global Reporting Initiative (GRI) and the United Nations Global Compact (UNGC) than AA&F companies do. In fact, M&M companies have higher average reporting rates for these two metrics than do all CSRHub-rated companies.

We suspect this difference may be due to the fact that AA&F companies have moved beyond basic reporting processes and towards more sophisticated methods. It may also be a result simply of selection effect when we compare a sample that has virtually all AA&F companies against the handful of M&M companies who have disclosed significant amounts of information.

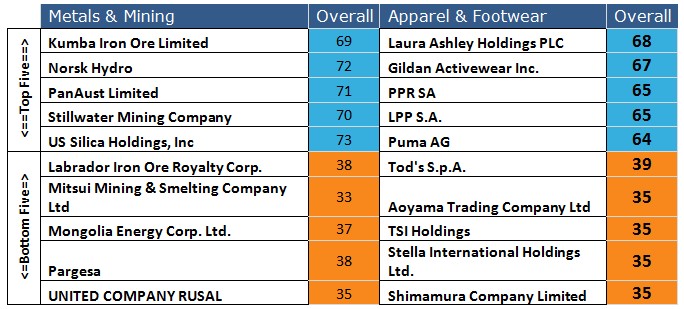

Another similarity is that the top five companies and bottom five companies in each industry look remarkably similar in terms of their perceived sustainability performance. The two industries show a similar range of CSR behavior.

More details on these findings are available in the SASS reports on these two industries.

See The SASS (Sustainable Accounting Standings Series) Apparel, Accessories and Footwear Industry Report.

See The SASS (Sustainable Accounting Standings Series) Metals & Mining Industry Report.

Bahar Gidwani is CEO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

Bahar Gidwani is CEO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

CSRHub provides access to the world’s largest corporate social responsibility and sustainability ratings and information. It covers over 15,000 companies from 135 industries in 132 countries. By aggregating and normalizing the information from 435 data sources, CSRHub has created a broad, consistent rating system and a searchable database that links millions of rating elements back to their source. Managers, researchers and activists use CSRHub to benchmark company performance, learn how stakeholders evaluate company CSR practices, and seek ways to improve corporate sustainability performance.