We are celebrating our latest milestone. We have now ingested more than 900 sources of ESG data.

Our 15 years of work have produced a database of 600 million pieces of ESG data on more than 50,000 entities. This data set supports our mission to use consensus ratings of company ESG performance as a lever to improve corporate sustainability.

Our reach now extends to 156 countries. Of the 53,427 entities we publish data on, 32,648 have received ratings, and 20,779 entities achieved full ratings. For the entities that we have full or partial ratings for, we are now at 9.54 rating sources per entity!

Our coverage has been boosted and the quality of our ratings have been enhanced by the ongoing integration of new data sources. Over the past three years, we have added 97 new sources. They include:

CDP, a global non-profit, manages the world's environmental disclosure system for entities like companies, cities, and regions. They recently licensed their data to CSRHub for inclusion in our ESG ratings. This data includes participation in CDP's environmental measurement systems, some of which include CDP’s carbon measurement, water, timber, cattle products, or palm oil systems. CDP is respected globally for its impact measurement approach, and serves as a direct resource for companies, not-for-profits, and government groups to access support in engaging with their initiatives.

GaiaLens, a fintech platform, integrates ESG information from both structured and unstructured sources. GaiaLens produces real-time ESG signals on 17,000 public companies to support investment decision-making. Its data complements and helps complete CSRHub’s consensus ESG performance signal—which is used by corporate managers, investors, consultants, and researchers.

Integrum ESG, which, from inception, has committed to total transparency with their ESG ratings. The data points of each rating are tied to underlying data drawn from company disclosures or information gathered using a natural language processing (NLP) system. The company deems this transparent approach “glass box,” enabling a view through the scores and the ability to scrutinize all underlying raw data themselves.

InvestVerte, a unique ESG ratings source that sets itself apart by catering to investors aiming to enhance their investment returns through ESG data. Unlike many investors who primarily use ESG data for regulatory or marketing compliance, InvestVerte targets those interested in using ESG signals to drive buy/sell decisions. The distinctive aspect of InvestVerte is its approach to analyzing ESG data. It employs machine learning to scour various sources for ESG-related information and enhances results for investment purposes using validation tools, robustness-checking algorithms, and AI techniques.

Lequity Group collects, organizes, and analyzes data from the thousands of federal, state, and local courts and regulatory bodies across the United States. Aggregating legal issue data requires Lequity to interface with and ingest data from disparate, scattered, and inconsistent legal systems. It uses this information to provide informative ESG data about the types, amounts, allegations, and outcomes of lawsuits and regulatory actions filed against companies. The insights we received from Lequity build on our growing dataset of US legal issues.

Ratio Institute is an independent nonprofit organization dedicated to accelerating measurable sustainability and viability in food retail through expert collaboration, industry resources, and practical tools. It works with food retailers, trade organizations, and other partners to create enterprise-level sustainability solutions that reduce costs, optimize internal practices, and improve overall performance. Ratio Institute consistently evaluated 127 ESG criteria across both 62 publicly-owned and 45 privately-owned entities in their “2022 ESG State of the Industry” report. This extensive analysis of US grocery store ESG performance covered the 107 largest grocery chains in the US, giving us deeper insights into the industry.

Our comprehensive array of over 900 strong, stable, and accurate entities incorporates Big Data aggregation of long-time data sources including Brand Finance, Covalence, ESG Book, GEMMAQ, Ideal Ratings, ISS ESG, Moody’s, MSCI, S&P Global, SIGWATCH. We have over 15 years of credible data history and consensus ratings that support businesses, investors, and stakeholders in making informed decisions and driving positive change within organizations. You can search by these sources using our advanced search feature.

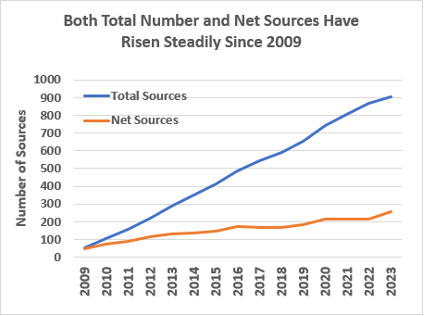

It is important to note that our 900 sources milestone is just a piece of our evolution. CSRHub works hard in consistent source management. With our data growth, many older sources naturally 'age out' over time. As we add newer sources to our network and maintain sources who continue to report data, older data sources are phased out to maintain the freshness, credibility, and relevance of the data and ratings we provide. You can see our growth in both total sources and net sources in the above graph.

We take immense pride in this progress and are thankful for your continued support. We look forward to what the future holds as we continue to expand our data coverage and tools.

About CSRHub

CSRHub offers one of the world’s broadest and most consistent set of Environment, Social, and Governance (ESG) ratings, covering 50,000 companies. Its Big Data algorithm combines millions of data points on ESG performance from hundreds of sources, including leading ESG analyst raters, to produce consensus scores on all aspects of corporate social responsibility and sustainability. CSRHub ratings can be used to drive corporate, investor and consumer decisions. For more information, visit www.CSRHub.com. CSRHub is a B Corporation.

.png)