By Guest Blogger, James Dennin, Kapitallwire

These nine financial services stocks have earned high ratings based on their treatment of employees.

As previously seen on Kapitallwire.

Back in late October the financial services sector was rocked when Goldman Sachs (GS) came to the not so startling conclusion that employees might produce even more for their company if they got a few hours off.

Goldman set up a special task-force to improve the quality of life for younger employees, who went on to set a policy proscribing Junior Analysts from working between 9PM on Fridays and 9AM on Saturdays. Ideally this will encourage more Goldman employees to stay at the firm for longer periods of time.

The blogosphere responded with a very emphatic "duh."

It seems however that many other firms have now followed suit. J.P Morgan expanded hiring at lower levels to have more hands to divvy up the work. Credit Suisse (CS) went with a similar proscription of Saturday work, although they added an extra four hours to their employee's weekends.

Investing ideas

But of course there's a caveat. Most banks still do business on the weekends. That's when many mergers happen. And the people in charge of those mergers still need support staff, to make those negotiations possible.

Which in turn has lead to more, outlandish suggestions. Such as this one columnist who seems to be suggesting unironically that all Junior Analysts simply sleep during the day, when many of them don't have that much to do anyway.

We decided to build a list of stocks in financial services that are already doing a good job of taking care of their employees. All the companies listed below work in the sector, but have extremely high ratings from their employees for exceptional compensation, training, benefits, and workers rights – data that was aggregated by our partners over at CSRHub.

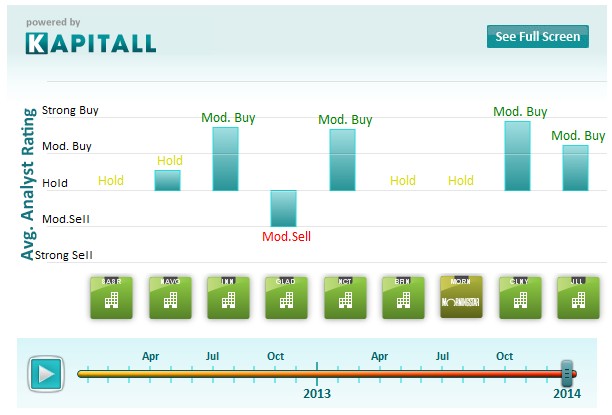

Click on the chart to view analyst ratings over time.

These financial services stocks seem to understand the importance of happy employees, but will it help their stock price? Use this list to begin your own analysis.

1. Sandy Spring Bancorp Inc. (SASR, Earnings, Analysts, Financials): Operates as the holding company for Sandy Spring Bank, which offers a range of commercial banking, retail banking, and trust services to individuals and businesses in Maryland. Market cap at $690.74M, most recent closing price at $27.42.

1. Sandy Spring Bancorp Inc. (SASR, Earnings, Analysts, Financials): Operates as the holding company for Sandy Spring Bank, which offers a range of commercial banking, retail banking, and trust services to individuals and businesses in Maryland. Market cap at $690.74M, most recent closing price at $27.42.

CSRHub Employee Rating: 66/100 vs. an average for the banking sector of 53.

2. Navigators Group Inc. (NAVG, Earnings, Analysts, Financials): Engages in the underwriting and management of property and casualty insurance in the United States, the United Kingdom, Belgium, and Sweden. Market cap at $892.96M, most recent closing price at $63.11.

2. Navigators Group Inc. (NAVG, Earnings, Analysts, Financials): Engages in the underwriting and management of property and casualty insurance in the United States, the United Kingdom, Belgium, and Sweden. Market cap at $892.96M, most recent closing price at $63.11.

CSRHub Employee Rating: 66/100 vs. an average for insurance carriers of 52.

3. Summit Hotel Properties, Inc. (INN, Earnings, Analysts, Financials): Engages in acquiring, owning, renovating, repositioning, and asset-managing and selling premium-branded limited-service and select-service hotels in the upscale and midscale without food and beverage segments of the United States' lodging industry. Market cap at $766.15M, most recent closing price at $8.87.

3. Summit Hotel Properties, Inc. (INN, Earnings, Analysts, Financials): Engages in acquiring, owning, renovating, repositioning, and asset-managing and selling premium-branded limited-service and select-service hotels in the upscale and midscale without food and beverage segments of the United States' lodging industry. Market cap at $766.15M, most recent closing price at $8.87.

CSRHub Employee Rating: 68/100 vs. an average for REITs of 50.

4. Gladstone Capital Corp. (GLAD, Earnings, Analysts, Financials): Operates as a closed-end, non-diversified management investment company. Market cap at $209.95M, most recent closing price at $9.88.

4. Gladstone Capital Corp. (GLAD, Earnings, Analysts, Financials): Operates as a closed-end, non-diversified management investment company. Market cap at $209.95M, most recent closing price at $9.88.

CSRHub Employee Rating: 69/100 vs. an average in diversified financial services of 53.

5. BankFinancial Corp. (BFIN, Earnings, Analysts, Financials): Operates as the holding company for BankFinancial, F. Market cap at $191.86M, most recent closing price at $9.48.

5. BankFinancial Corp. (BFIN, Earnings, Analysts, Financials): Operates as the holding company for BankFinancial, F. Market cap at $191.86M, most recent closing price at $9.48.

CSRHub Employee Rating: 70/100 vs. an average for banking of 53.

6. Newcastle Investment Corp. (NCT, Earnings, Analysts, Financials): Operates as a real estate investment and finance company that invests in and manages a portfolio consisting primarily of real estate securities. Market cap at $1.70B, most recent closing price at $5.76.

6. Newcastle Investment Corp. (NCT, Earnings, Analysts, Financials): Operates as a real estate investment and finance company that invests in and manages a portfolio consisting primarily of real estate securities. Market cap at $1.70B, most recent closing price at $5.76.

CSRHub Employee Rating: 74/100 vs. an average for REITs of 50.

7. Morningstar Inc. (MORN, Earnings, Analysts, Financials): Provides independent investment research to investors worldwide. Market cap at $3.58B, most recent closing price at $78.27.

7. Morningstar Inc. (MORN, Earnings, Analysts, Financials): Provides independent investment research to investors worldwide. Market cap at $3.58B, most recent closing price at $78.27.

CSRHub Employee Rating: 74/100 vs. an average for brokerage and capital markets of 53.

8. Colony Financial, Inc. (CLNY, Earnings, Analysts, Financials): Focuses on acquiring, originating, and managing commercial mortgage loans and other commercial real estate-related debt investments. Market cap at $1.62B, most recent closing price at $20.79.

8. Colony Financial, Inc. (CLNY, Earnings, Analysts, Financials): Focuses on acquiring, originating, and managing commercial mortgage loans and other commercial real estate-related debt investments. Market cap at $1.62B, most recent closing price at $20.79.

CSRHub Employee Rating: 74/100 vs. an average for REITs of 50.

9. Jones Lang Lasalle Inc. (JLL, Earnings, Analysts, Financials):Provides integrated real estate and investment management services to owner, occupier, and investor clients worldwide. Market cap at $4.64B, most recent closing price at $104.24.

9. Jones Lang Lasalle Inc. (JLL, Earnings, Analysts, Financials):Provides integrated real estate and investment management services to owner, occupier, and investor clients worldwide. Market cap at $4.64B, most recent closing price at $104.24.

CSRHub Employee Rating: 77/100 vs. an average for real estate brokers of 54.

(List compiled by James Dennin. Analyst ratings sourced from Zacks Investment Research, Employee Ratings sourced from CSRHub. All other data sourced from Finviz.)

Analyze These Ideas: Getting Started

- Read descriptions for all companies mentioned

- Access a performance overview for all stocks in the list

- Compare analyst ratings for the companies mentioned

- Compare analyst ratings to annual returns for stocks mentioned

- Real-Time Opinion: Scan the latest tweets about these companies (feed will open in a new window)

Dig Deeper: Access Company Snapshots, Charts, Filings

- Sandy Spring Bancorp Inc.(SASR, Chart, Download SEC Filings)

- Navigators Group Inc.(NAVG, Chart, Download SEC Filings)

- Summit Hotel Properties, Inc.(INN, Chart, Download SEC Filings)

- Gladstone Capital Corp. (GLAD, Chart, Download SEC Filings)

- BankFinancial Corp.(BFIN, Chart, Download SEC Filings)

- Newcastle Investment Corp.(NCT, Chart, Download SEC Filings)

- Morningstar Inc.(MORN, Chart, Download SEC Filings)

- Colony Financial, Inc.(CLNY, Chart, Download SEC Filings)

- Jones Lang Lasalle Inc.(JLL, Chart, Download SEC Filings)

ABOUT US

© Kapitall, Inc. All rights reserved. Kapitall Wire is a division of Kapitall, Inc. Kapitall Generation, LLC is a wholly owned subsidiary of Kapitall, Inc.

Kapitall Wire offers free cutting edge investing ideas, intended for educational information purposes only. It should not be construed as an offer to buy or sell securities, or any other product or service provided by Kapitall Inc., and its affiliate companies.

Open a free account today get access to virtual cash portfolios, cutting-edge tools, stock market insights, and a live brokerage platform through our affiliated company, Kapitall Generation, LLC.

Securities products and services are offered by Kapitall Generation, LLC - a FINRA/SIPC member.

CSRHub provides access to corporate social responsibility and sustainability ratings and information on 8,900+ companies from 135 industries in 104 countries. By aggregating and normalizing the information from 300+ data sources, CSRHub has created a broad, consistent rating system and a searchable database that links millions of rating elements back to their source. Managers, researchers and activists use CSRHub to benchmark company performance, learn how stakeholders evaluate company CSR practices and seek ways to change the world.