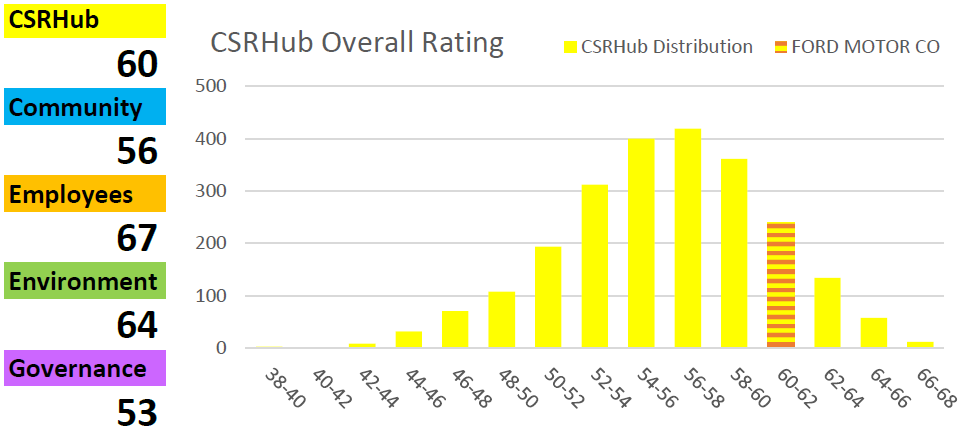

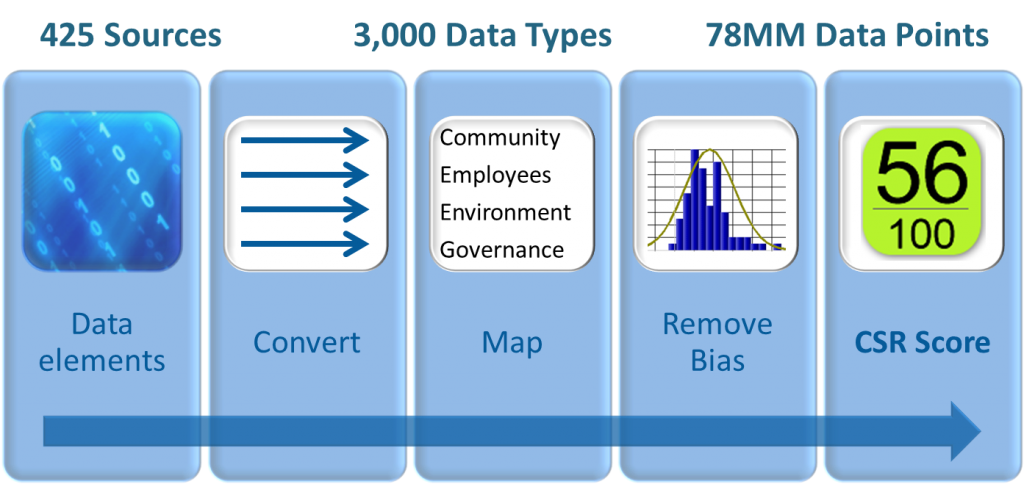

API, Bloomberg ESG, Data Analytics, ESG ratings, ESGHub, business investment, Application development, Application program interface, Fully rated, investment management, ESG App Development

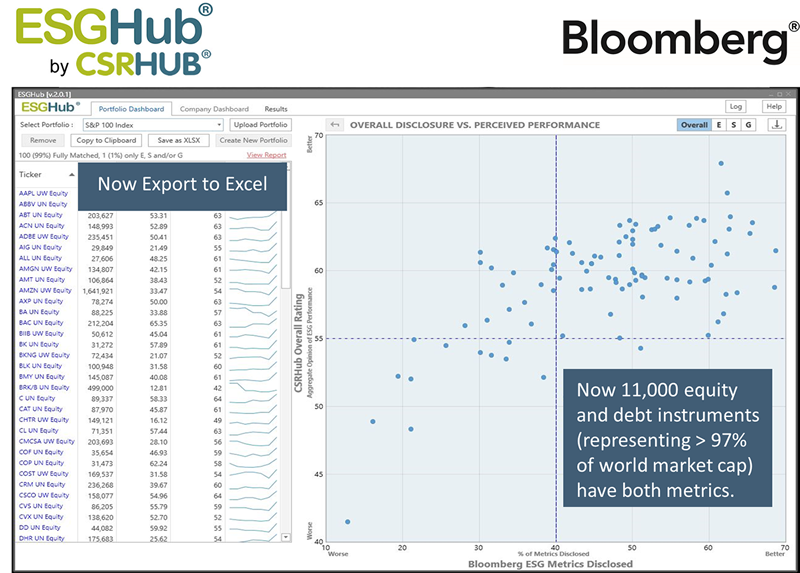

ESGHub 2.0 Now Available with Extended Coverage and Excel Download Capability

By CSRHub Blogging