Accountability, Asset4/Thomson Reuters, Bahar Gidwani, Better World, Big Data, Carbon Disclosure Project, CorporateRegister, CR 100, EICC, EIO, EIRIS, EPEAT, ESG, FCPA, GovernanceMetrics International/Corporate Library, Government & Consumer, social, Investment-related sources, UN Global Compact, Working Mother, IW Financial, MSCI, socially responsible investment, Top 50 Socially Responsible, Trucost, UNODC, Vigeo, Activists and NGOs, and Governance, Black Engineer, BSR, CSRHub, environment, Hewlett Packard, SRI, ESG Investing, ESG Metrics Research

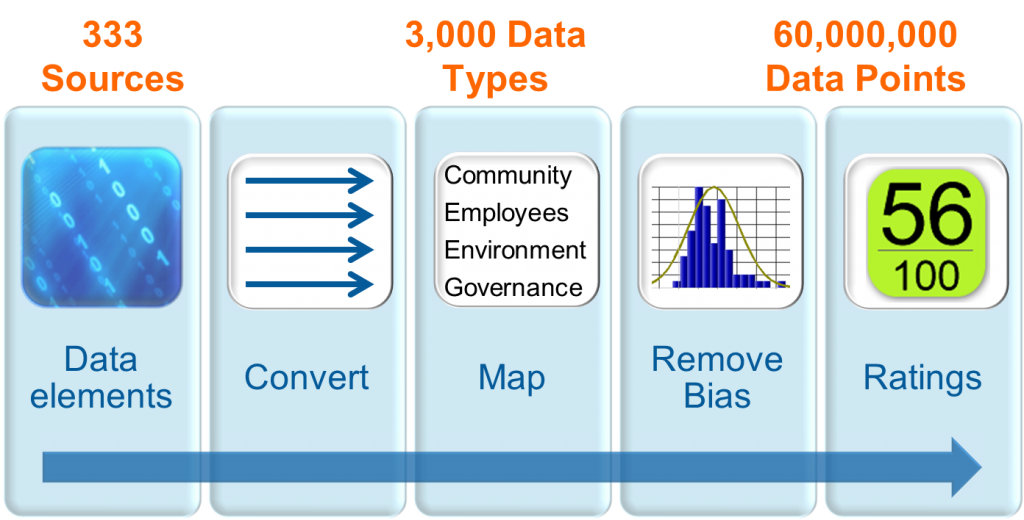

A Big Data Approach to Gathering CSR Data

By Bahar Gidwani