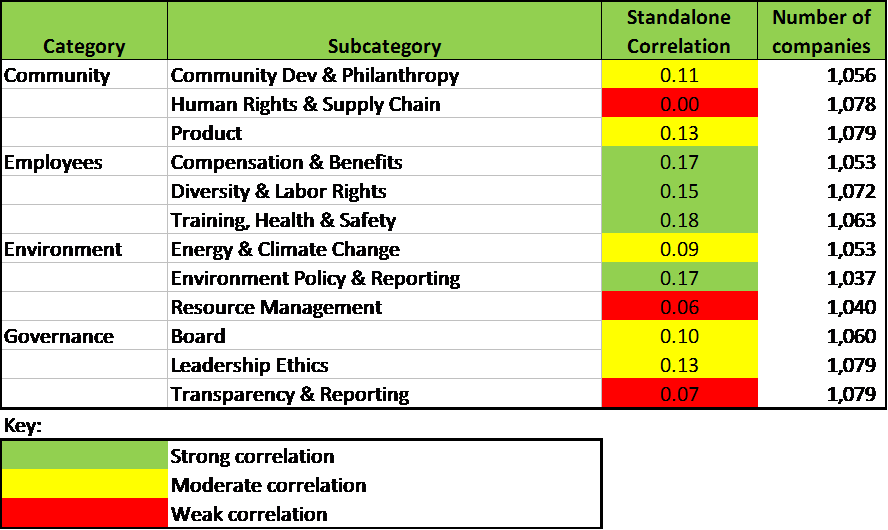

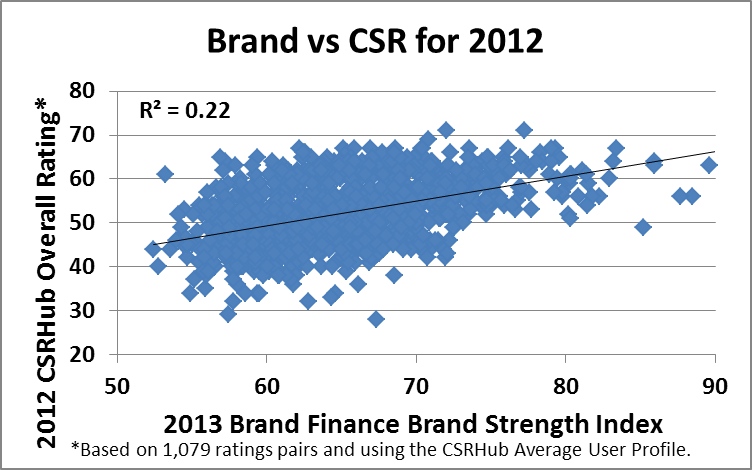

CSR, governance, social, community relations, ESG ratings, greenhouse gas reduction, impact investments, ImPactSpace, supply chain security, CSRHub, environmental, ESG Investing, ESG Data Partnerships

ImpactSpace and CSRHub bring environmental, social and governance (ESG) ratings to impact investments

By CSRHub Blogging